Services

SUMMARY OF BUSINESS SUPPORT SERVICES.

Statutory Audit.

To enhance credibility of the firm by ensuring compliance with the provisions of law, international reporting standards international auditing standards and the public sector accounting standards.This involves or auditing for external reporting as required by the law of the land. The benefits of having an audit are;

It gives credibility to your company as a whole

Enhances acceptability of your financial statements and reports

Banks and lenders require alone proposals to be supported by financial statements that have been audited

To ensure compliance with the prevailing labor regulations and legislation

Accounting and Book-Keeping Services.

To process management information, to help the entrepreneur director make an informed accurate and timely decisions on the day to day operations of the business. Generally and in particular in the key operational areas of sale, purchase expenses, and profitability.

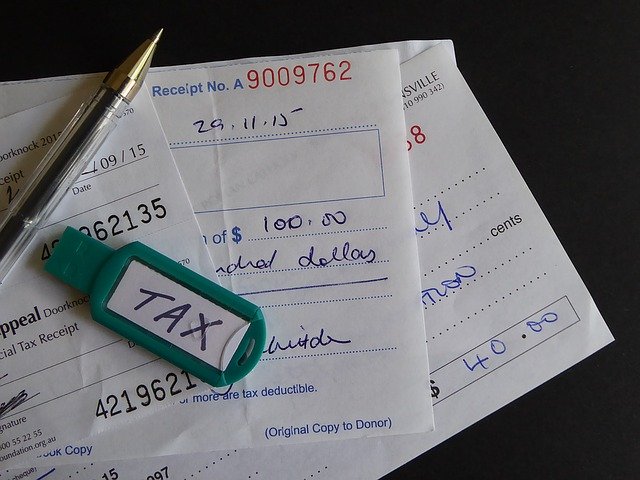

Taxation

To provide a framework of managing tax requirements and compliance; an area that is closely supervised by tax agents and non-compliance can result in heavy penalties and prosecution.

Avoidance is legal but tax evasion is it requires expert knowledge to distinguish between tax avoidance and evasion to avoid criminal offense.

This will involve the following aspects of taxation

Business survival tax governance

Tax planning and compliance non-compliance is double Jeopardy in the current situation (VAT income tax installments tax).

Payroll Administration.

To provide information on the human resource cost of the condition.

To manage employee costs next nine to ensure compliance with prevailing labor regulations and legislation.

This area is closely supervised by the labor regulations and non-compliance and lead to litigation and penalties against the defaulting companies.

Associate Consultants

The associate seniors are the members of the group legible for the mission as partners in the case of CPA holders or directors of the company.

In association seniors have experience gained from diverse associations are well-versed and informed international an international development issues they are retained by the farm on the basis of the cutting edge expertise.

Currently the following are the associate seniors.

NAME

AREA OF EXPERTTISE

POSITION IN THE FIRM

Barango DM

Tax ,Auditing-Accounting.

Tax/Auditing consultant.

Munyeke. M

Tax.

Tax Consultant

Ochieng Leonard.

Tax & Auditing.

Tax/Auditing Consultant

Angaruki J

ICT Lead

IT Consultant

Chepchieng Joram.

Accounting & Auditing

Project Manager.

CPA (DR) A.G Soprine

Risk Analysis, Strategy Management.

Consultant.

PHD A. Mukhwana

Governance and Risk

Consultant.

PHD J. N Musyoki

Marketing

Consultant

Aldrin Ojiambo. counsel

Law practitioner

Legal Counsel

Gabriel Nyangweso

Forensic Audit Company Secretarial Tax Management.

Director Oracle.